Selling a Restaurant in Tennessee: A Practical Guide

Selling a restaurant is one of the most significant decisions an owner can make. Whether you’re ready to retire, pivot to a new business, or simply...

2 min read

Joseph Steigman : Updated on February 23, 2026

Many business owners begin the selling process by asking:

“What’s my business worth?”

That’s a smart question—but the wrong answer can lead to overpricing and lost deals.

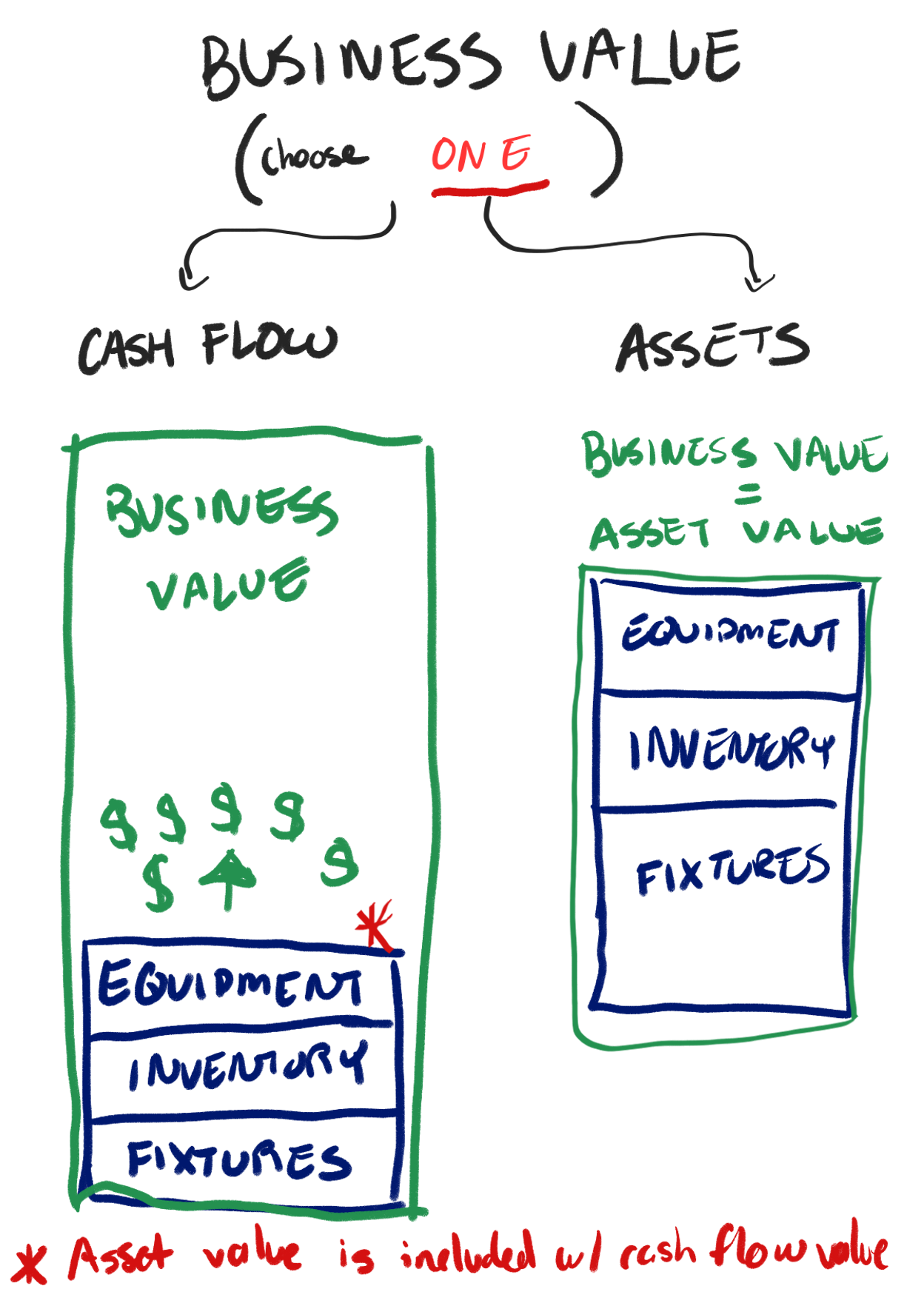

One of the biggest misunderstandings in business valuation is trying to add the value of equipment, fixtures, and inventory on top of a cash flow-based price.

That’s called double dipping—and it’s one of the fastest ways to lose a serious buyer.

As a Nashville business broker, I often explain that business value comes from one of two sources:

Business value isn’t a buffet.

If you’re pricing your business based on cash flow (SDE or EBITDA), that already includes equipment, inventory, and fixtures. You can’t add them again on top—you have to choose ONE valuation method.

This method values the business based on its earning – some measure of cash flow. This is usually worth more than if someone just bought the equipment, machines and inventory. This price includes all assets. If your business is very profitable, it is usually better to value the business based on cash flow.

This model prices the business based on the fair market value (FMV) of:

But it does not include any premium for cash flow, customer base, or brand goodwill. This is usually done because a business is not very profitable and the value of the equipment is greater than a multiple of cash flow. A manufacturer that has been winding down its business, for example, may have greater value in the remaining equipment and machines than in the cash flow its generating.

Maybe it was when you bought it, but an asset based valuation is usually based on fair market value. Which means it is usually worth much less than what you bought it for or what can be bought new today. If you have fully depreciated the equipment on your balance sheet, do not expect a high fair market value on your equipment.

Trying to price your business using a multiple on earnings and then add separate charges for inventory or equipment is a mistake. It’s like charging for the same thing twice.

Cash flow doesn’t exist in a vacuum.

You can’t sell a business for its earnings and charge separately for the equipment that generates those earnings. The cash flow value depends on the assets being included—and it’s usually worth more.

That kind of pricing:

I like to call cash flow your “in your pocket money.” When figuring out what your business is worth we need need to determine profitability, and the value of other benefits your business provides to you. What else do you expense through your business that we can add back?

At Legacy Entrepreneurs, I help owners understand what their business is worth, avoid double dipping, and walk into negotiations with confidence.

Selling a restaurant is one of the most significant decisions an owner can make. Whether you’re ready to retire, pivot to a new business, or simply...

If you’re considering selling your business but concerned about the tax hit, you’re not alone. Many business owners hesitate to exit because of the...

When a business owner hits a turning point — whether that’s scaling up, stepping away, or preparing for a sale — the next hire can dramatically shape...